Asset Depreciation

Whatever the size of your business, long-term assets like tools and equipment can be big investment and need to be accounted for both accounting and tax purposes.

ToolWorks includes automatic asset depreciation calculations for Tools and Equipments, as well as support for Fiscal Year.

Start Tracking NowWhat is asset depreciation?

Depreciation is a key component in understanding your business's profitability and is recorded on the income and balance statements. Depreciation is the decrease in the value of assets and the method used to reallocate, or "write down" the cost of a tangible asset over its useful life span.

Straight-line Depreciation

Straight line depreciation is a common method of depreciation where the value of a fixed asset is reduced gradually over its useful life. Each full accounting year will be allocated the same amount of the percentage of asset’s cost when you are using the straight-line method of depreciation.

In order to calculate depreciation using this method, you will need the following three inputs:

Useful Lifespan of asset The useful life is the time period over which the organization or company considers the fixed asset to be productive. The useful life is measured in years.

Cost of Asset The asset cost is the total price of the asset

Salvage Value of asset When a fixed asset comes to the end of its useful life and is fully depreciated, the company may continue to use it or consider selling it at a reduced amount. This is known as the salvage value of the asset.

Straight Line Annual Deprecation = ( Cost of Asset - Salvage Value of asset ) / Useful Lifespan of asset

Example

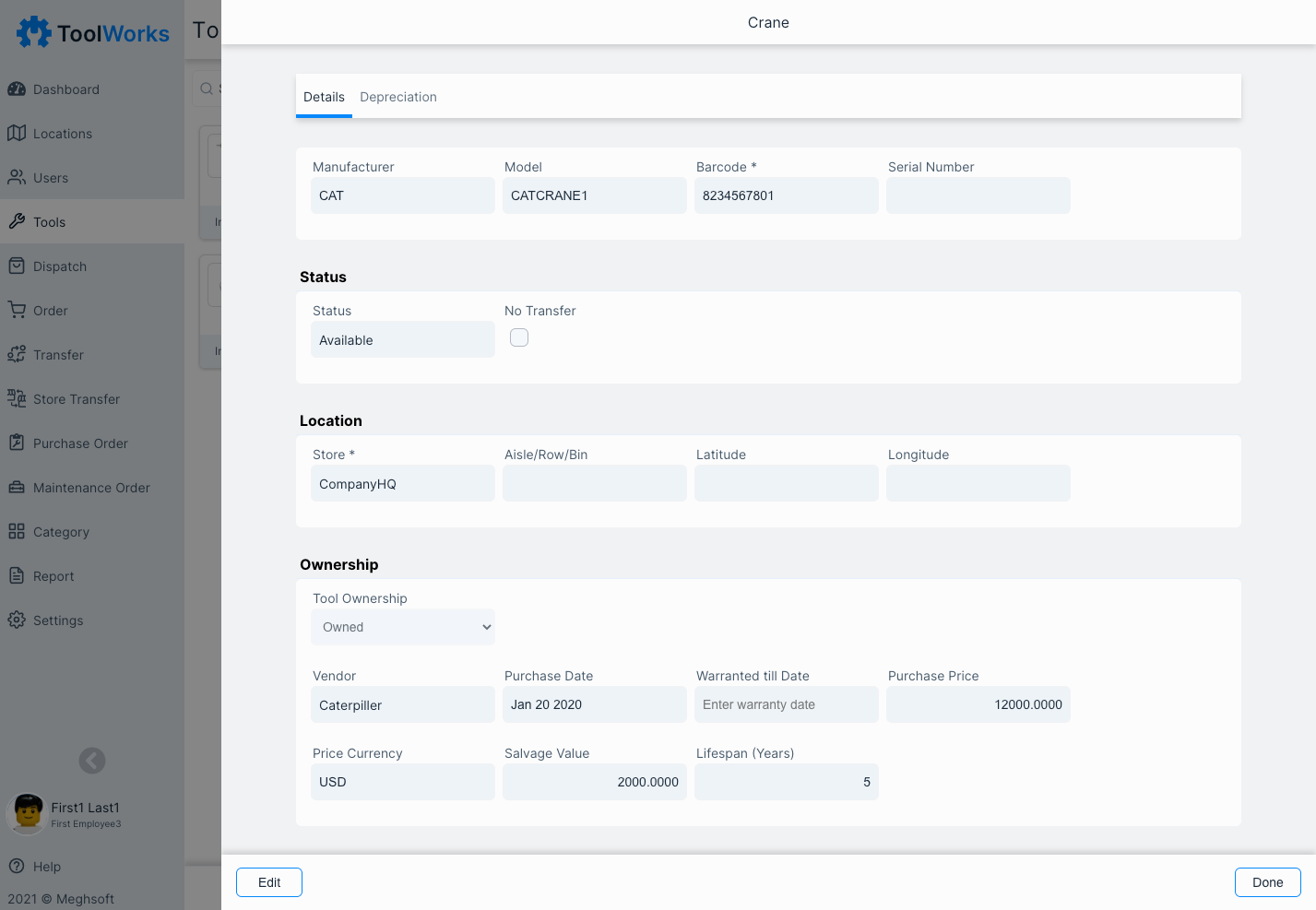

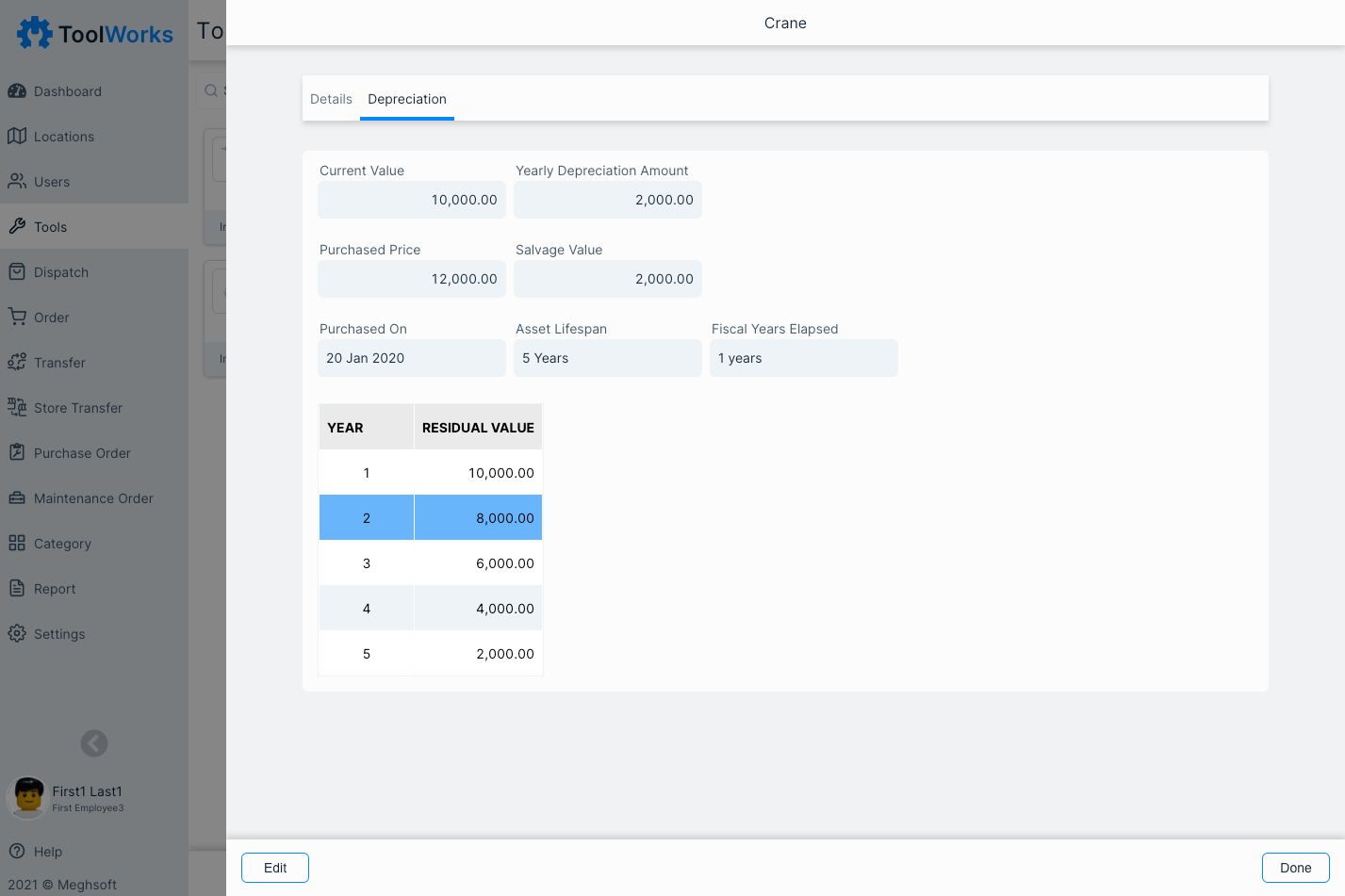

Lets say you purchased a new equipment. Equipment Costs $12,000 and it is expected to have salvage value of $2,000 and useful life of 5 years.

Given these assumptions, its annual depreciation expense is: ( 12000 - 2000 ) / 5 = 2000

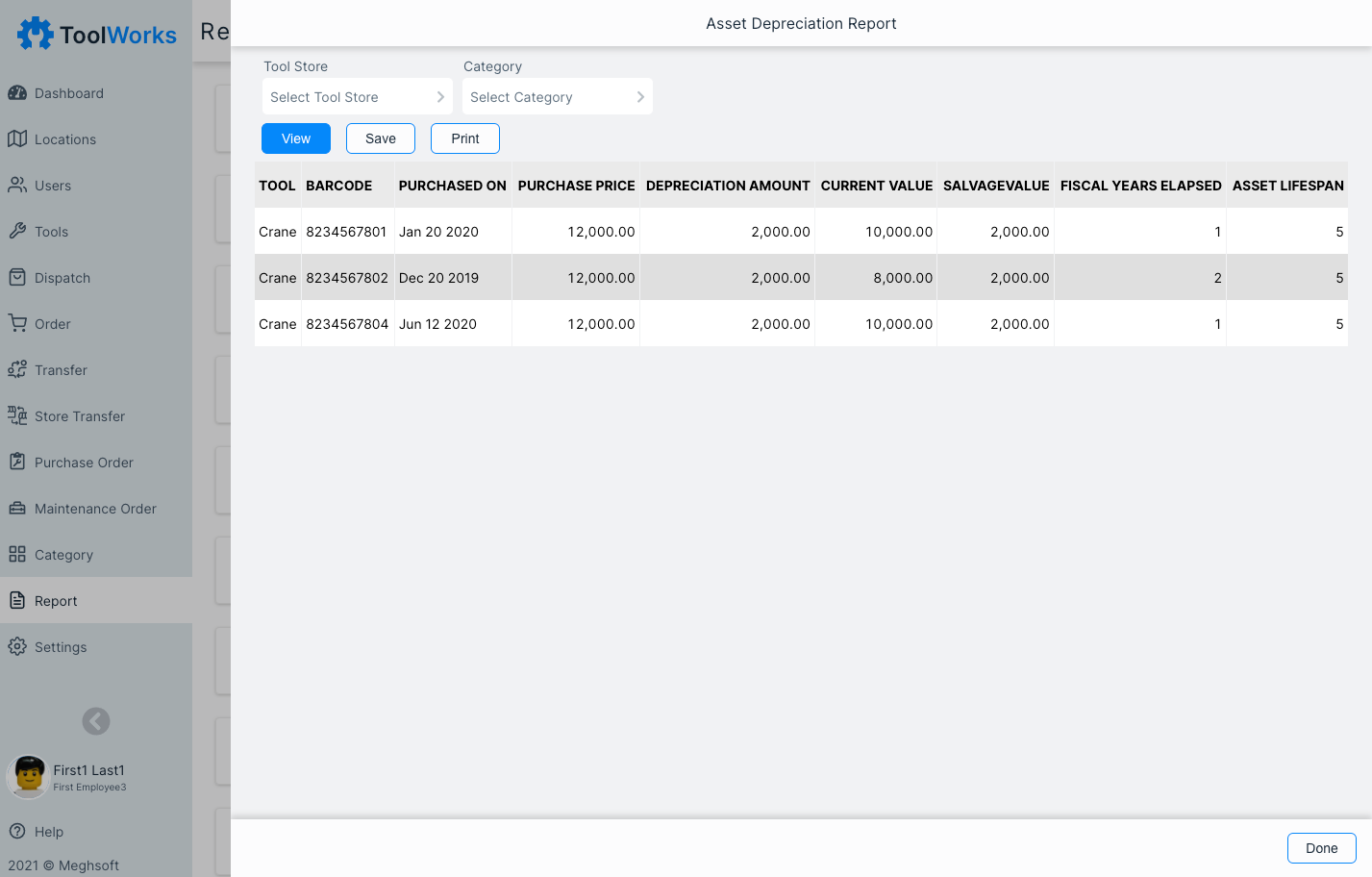

Report

Asset Depreciation report show depreciation for list of assets.

Explore Other Features

Field Order Enable field users to order tools from field using easy to understand online shopping based experience.

Field Transfer Allow field users to transfer tool to other users in field while keeping proper audit trail.

Maintenance Plan, schedule and carry out detailed equipment maintenance work . Efficiently track service work from start to finish on the go with mobile app.

Asset Checkout / Check-in Scan barcode, QRCode or labels on tools to quickly check out tools and automatically flow up when they are over due.

Store Transfer Easily track and transfer tools from one location to other and re-balance inventory across entire organization with automatic audit of transfer.

Purchase Orders Utilize Digital Purchase Orders to buy tools and supplies from external vendors, with approval workflow and automatic audits.